Read also:

- Ghana Aims for $20 Billion Reserves by 2029 as 24-Hour Economy Takes Shape

- I will be ordering more fugu for myself – President Hakainde Hichilema

- Payment delays: COCOBOD working on solutions – Randy Abbey assures cocoa farmers

- Kandifo Institute Withdraws Petition Over Alleged Unlawful Activities in Goldbod Operations

- Ghana-Zambia relations strengthen as smock diplomacy boosts AfCFTA ties

Els: MBN360 Securities/Markets

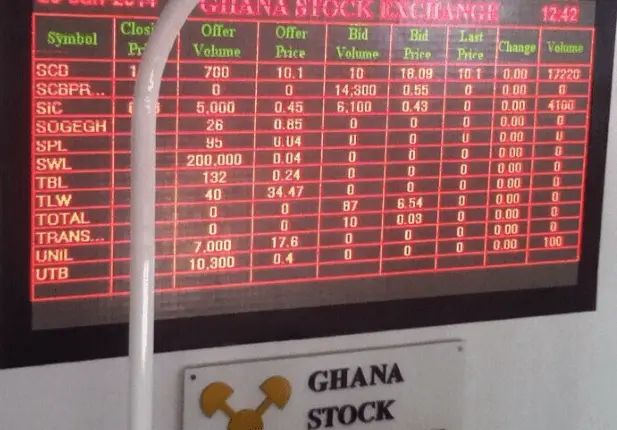

The Ghana Stock Exchange ended the final weekday trading session on a positive note, recording massive gains that reinforced investor confidence in the market.

Trading activity reflected renewed optimism as key equities posted appreciable price increases, pushing both the benchmark and financial indices higher. The session’s performance capped a week of steady recovery and underscored growing interest in fundamentally strong stocks across sectors.

In aggregate, 12 listed equities participated in trading during the session, with five stocks recording gains and only one equity ending in negative territory. The overall market sentiment remained bullish, driven by strong performances from insurance, banking and telecommunications stocks.

SIC Insurance Leads Market Gainers

SIC Insurance Company emerged as the top gainer of the session, posting an impressive 9.6 percent share price appreciation to close at GHS 1.37 per share. The strong showing by SIC Insurance reflected sustained investor demand for insurance stocks, particularly those perceived as undervalued with growth potential.

Fan Milk followed with a 2.5 percent increase in its share price, supported by stable demand for consumer goods stocks. GCB Bank also closed the session higher, recording a 0.31 percent gain, while MTN Ghana added 0.24 percent to its share price. These gains, though modest in percentage terms, played a significant role in lifting overall market performance due to their market weight.

The only equity to record a loss during the session was CalBank, which shed 1.23 percent of its value. Despite this decline, the broader banking sector remained resilient, as reflected in the strong performance of the financial stocks index.

Trading Volumes Highlight Investor Activity

MTN Ghana again recorded the highest trading volume during the session, with 1.44 million shares changing hands. This highlighted sustained investor interest in the telecommunications giant, which remains one of the most actively traded stocks on the exchange.

CalBank followed with a trading volume of 1.12 million shares, despite closing the session in negative territory. SIC Insurance Company recorded 153,500 traded shares, while Fan Milk accounted for 121,175 shares. These figures indicated selective investor participation, with activity concentrated in a few highly liquid equities.

At the close of the session, a total of 2,908,434 shares were traded on the market, corresponding to a total market value of GHS 8,453,149.52.

Composite Index Extends Weekly Gains

Performance of the GSE market indices further confirmed the bullish sentiment. The benchmark GSE Composite Index increased by 101.32 points, representing a 1.12 percent rise, to close at 9,152.65 points. This marked a one week gain of 1.62 percent and a four week gain of 3.92 percent, while the year to date return stood at 4.36 percent.

The steady upward movement of the composite index reflected broad based gains across multiple sectors and signaled improving market stability. Analysts note that consistent gains over successive weeks often encourage long term investors to increase exposure to equities.

Financial Stocks Index Records Strong Performance

The GSE Financial Stocks Index also closed the session higher, gaining 0.9 percent to reach 5,036.96 points. This performance translated into a one week gain of 2.12 percent and a four week gain of 7.87 percent. On a year to date basis, the financial index recorded an impressive gain of 8.39 percent.

The strong showing by financial stocks underscored renewed confidence in the banking and insurance sectors, driven by improved earnings outlooks and expectations of macroeconomic stability. Market watchers believe that sustained gains in the financial index could continue to support overall market growth in the near term

The positive trading session also resulted in an increase in the market capitalization of the Ghana Stock Exchange, which rose to GHS 180.7 billion. The GSE market capitalization did not hold back since hitting the GHS 180 billion mark in recent trading sessions The rise in market capitalization reflected the cumulative impact of price gains recorded by leading equities during the session.

A growing market capitalization is often seen as a sign of increased investor confidence and improved valuation of listed companies. It also enhances the attractiveness of the exchange to both domestic and foreign investors seeking exposure to Ghana’s equity market.

Volume and Turnover Decline Despite Gains

Despite the strong price performance, trading data showed a significant decline in market activity compared with the previous trading day. Compared with Thursday, February 5, trading volume declined by 92 percent, while turnover dropped by 95 percent.

Market analysts attributed the decline in activity to profit taking and cautious positioning by investors ahead of the new trading week. Nonetheless, the sharp gains recorded by key indices suggested that price momentum remained intact despite lower volumes.

The massive gains recorded at the close of the final weekday trading session reinforced the positive outlook for the Ghana Stock Exchange. With indices trending upward and market capitalization expanding, investors are expected to continue monitoring corporate earnings and macroeconomic indicators for further direction.

If current momentum is sustained, the market could see additional gains in the coming weeks, supported by strong performances from financial, insurance and telecommunications stocks.